Vendor risk management (VRM) is no longer a checkbox. Third-party breaches aren’t edge cases, they’re the main event. In 2024, a number of companies suffered a vendor-triggered incident, averaging $4.81 million in damages, about 40 percent more than an in-house breach.

This 2026 buyer’s guide shows you how to shrink that risk with tighter disclosure timelines, AI-driven assessments, and eight proven moves you can start today. Keep reading to replace spreadsheet sprawl with real-time monitoring, tier suppliers by business impact, and respond in hours, not weeks, when trouble hits.

Table of Contents

ToggleThe 2026 vendor-risk outlook: five forces boards can’t ignore

Vendor risk now tops the audit-committee docket, and five measurable forces explain why.

1. Digital ecosystems keep expanding

Global vendor lists are ballooning. Gartner’s 2023 survey found that 71 percent of organizations now manage more third-party providers than three years ago, and the same share expects that roster to grow again by 2026. Every new connection widens the blast radius. Sonatype recorded a 156 percent year-over-year jump in malicious open-source packages in 2024, showing that attackers target the links between partners as much as the partners themselves.

The 2020 SolarWinds breach makes the risk tangible: one poisoned build server reached more than 18,000 customers. Without real-time oversight, each extra API key, cloud tenant, or IoT sensor becomes another hop for adversaries, and risk scales faster than manual tracking can keep up.

2. Regulators tighten timelines and liability

Compliance windows are closing fast. In the European Union, the Digital Operational Resilience Act became binding on January 17, 2025, giving supervisors new power over “critical ICT third-party providers” that support financial institutions. The bloc’s NIS2 Directive took effect on October 18, 2024, extending mandatory cybersecurity controls and breach-notification duties to hundreds of additional sectors.

Across the Atlantic, the U.S. SEC’s July 2023 rule requires public companies to disclose any material cyber incident, including one at a vendor, within four business days of deeming it material. Financial services face an extra hurdle: the FTC Safeguards Rule, updated in May 2024, obliges non-bank lenders and brokers to notify the FTC within 30 days of a breach affecting 500 customers or more.

Regulators now treat third-party lapses as first-party failures. Manual checklists cannot meet these deadlines; companies need automated evidence collection and real-time monitoring to stay out of the penalty headlines.

3. Trust extends beyond security

Board agendas now weigh carbon footprints and human rights alongside firewalls. The shift is data-driven: 80 percent of global consumers say they will pay a premium, about 9.7 percent on average, for goods produced sustainably, and 18 percent have already stopped buying from a brand to back a social cause.

Regulators and investors add more pressure. The EU’s forthcoming Corporate Sustainability Due Diligence Directive will require large companies to trace forced-labor risk across their supply chains, and U.S. Customs has detained more than $1 billion in goods since 2023 under the Uyghur Forced Labor Prevention Act. A supplier’s ethical lapse can freeze inventory at the port and spark a social-media boycott on the same day.

For VRM teams, the core question shifts from “Is the vendor secure?” to “Is the vendor trustworthy?” Security questionnaires now sit beside ESG scorecards, whistle-blower hotlines, and Scope 3 emissions attestations. Ignoring ethics is no longer a PR gamble; it is a balance-sheet risk.

4. Automation becomes the baseline

Security teams have reached their limit on manual VRM tasks. IBM’s 2024 Cost of a Data Breach report shows that organizations that fully deploy security AI and automation cut breach costs by about 2.2 million dollars on average, which is nearly 40 percent less than peers that still rely on manual workflows. Within third-party programs, the efficiency gains are just as clear. An UpGuard case study reported a 75 percent drop in vendor assessment time after teams moved away from spreadsheets and adopted an automated platform. A 2025 Secureframe survey also found that 54 percent of users complete compliance tasks at least 30 percent faster when AI features are built into the workflow.

Gartner forecasts that about 50 percent of VRM programs will use AI to reduce staffing needs by 25 percent or more by 2028. Automation is becoming the baseline for keeping up with disclosure timelines and expanding vendor ecosystems. Teams that stay on spreadsheets struggle with slow onboarding, outdated evidence, and higher breach costs. Vanta provides an example of how modern vendor risk tools address these issues in its guide to leading VRM platforms, which explains how automated evidence collection and real-time monitoring help close those gaps.

5. VRM and ERM converge into one risk lens

Risk committees are tired of juggling siloed dashboards. A December 2023 Gartner survey found that 45 percent of organizations faced a business interruption tied to a third-party cyber event within the previous two years. As a result, 67 percent of chief risk officers now place vendor failure among their top five enterprise threats, up from 49 percent in 2021.

These numbers have sparked a tooling rethink. Modern GRC platforms and security-ratings providers merge external-vendor telemetry with internal controls so boards can view one heat map covering revenue, compliance, and cyber posture. The payoff is faster budget decisions, clearer accountability, and fewer unknown-unknowns when a supplier stumbles. In short, vendor risk management is no longer adjacent to enterprise risk management; it now opens the same report.

These forces set the stage for the eight best-practice moves that follow, helping you stay compliant, resilient, and trusted in 2026.

1. Replace spreadsheets with purpose-built automation

Manual trackers splinter once your vendor list passes a few dozen lines. A 2025 UpGuard case study shows a global retailer cut assessment time by 75 percent after switching to an automated VRM platform. IBM’s 2025 Cost of a Data Breach report adds that organizations that fully deploy security AI and automation save about $1.9 million per breach compared with peers that rely on manual workflows.

Purpose-built tools handle the repetitive work, pulling evidence from portals, flagging expiring certifications, and pushing live risk scores into GRC, procurement, and ticketing systems. Because many teams now treat automation as the foundation of their compliance workflow, they often turn to continuous compliance platforms like Vanta to centralize evidence gathering and certification tracking so analysts can move from chasing spreadsheets to investigating the signals that matter, and every stakeholder sees the same current truth.

The question is no longer whether automation pays off; it is how long you can tolerate the latency and blind spots of a cell-based approach. Adopt a platform early so your VRM program scales with the business instead of against it.

2. Formalize a VRM framework that aligns with enterprise risk

Policy, not software, grants authority. Yet 60 percent of organizations have never completed a formal assessment of third-party risk. A 2023 Gartner survey reports that only 6 percent of programs hit the mark on efficiency, resilience, and board influence.

A written framework closes the gap by:

- Defining scope, roles, and decision rights. Who approves high-risk cloud providers? Who controls remediation budgets? Document answers so procurement, security, and legal stop working from separate playbooks.

- Mirroring enterprise-risk scoring. Apply the same impact-probability math to vendors that finance teams use for internal projects, then feed results into dashboards executives already trust.

- Requiring continuous review. Schedule annual policy updates, and trigger ad-hoc reviews after major incidents or regulatory changes.

When board members view third-party heat maps beside operational and financial metrics, they grasp total exposure in seconds, and the VRM team gains the mandate, plus budget, to enforce controls.

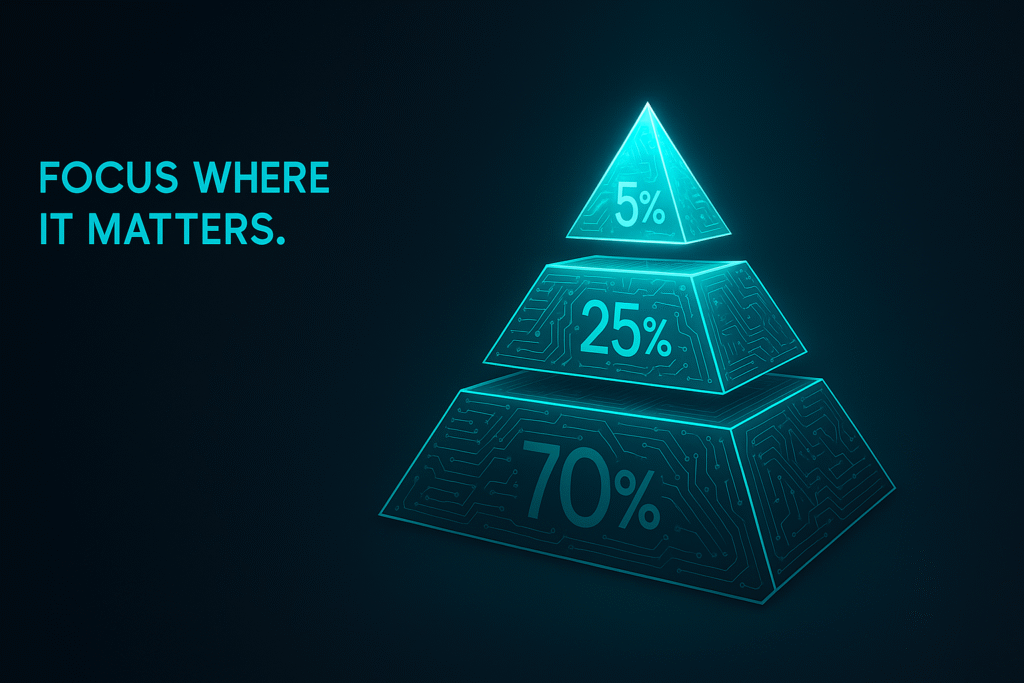

3. Tier vendors by real-world risk

Gartner calls tiering “the single highest-ROI move in third-party oversight” because a small slice of suppliers drives most of the exposure. Bitsight’s 2024 review of 41,000 financial firms found that just 99 vendors—less than 0.3 percent of relationships—represent system-level cyber risk for the sector. Yet institutions monitor only 36 percent of their vendors on average, wasting cycles on low-impact partners.

A pragmatic model sorts providers into High, Medium, and Low tiers using four weighted factors:

- data sensitivity they handle

- operational or revenue impact if they fail

- regulatory touchpoints (for example, GDPR, HIPAA)

- their own security maturity score

Apply deeper diligence where risk concentrates. High-tier vendors need annual on-site reviews, tight contractual clauses, and continuous monitoring. Medium tier receives remote assessments and quarterly check-ins. Low tier follows an attest-and-alert schedule.

Annual (or event-driven) re-scoring keeps pace with scope creep, such as a payroll vendor that expands into EU processing or a SaaS host that earns a SOC 2 Type II. Focusing resources on the riskiest few cuts audit fatigue and surfaces issues before they reach operations or headlines.

4. Guard the front door with rigorous onboarding

Onboarding is where negotiating power peaks and visibility is clearest, yet 62 percent of companies have not increased the rigor of their third-party due diligence during the past two years. That blind spot helps explain why 35 percent of cyber leaders rank supplier breaches among their top threats for 2025.

A resilient playbook includes:

- Structured risk assessment. Request security policies, certification evidence (for example, SOC 2 or ISO 27001), incident history, and, when the service is critical, business-continuity plans. The goal is to spot gaps while contract terms are still negotiable.

- Contractual safeguards. Add data-protection clauses, 24-hour breach-notification rules, and audit rights. Well-drafted terms shift part of the financial and compliance exposure back to the source.

- Least-privilege access and ownership. Do not enable production credentials until a named internal owner signs off and access scopes are documented.

With this discipline in place, vendors start on solid ground, and shadow suppliers never slip through the cracks.

5. Monitor vendors continuously, not annually

Annual questionnaires create dangerous blind spots. Bitsight’s 2025 State of Cyber Risk report found that mature programs are 4.5 times more likely to monitor every vendor in real time, yet only one in three organizations actually does so. The cost of inaction is clear: 30 percent of breaches in 2024 involved a third party, double the prior year.

Continuous-monitoring platforms stream breach reports, exposed credentials, misconfigured ports, and dark-web chatter into your SIEM at all hours. A dip in a vendor’s security rating or an expired SOC 2 certificate triggers an instant alert, buying precious hours to isolate integrations or invoke contractual remedies.

Begin with your high-tier suppliers, integrate their feeds, and widen the circle each quarter. The once-a-year survey is not just slow; it multiplies risk you cannot accept in 2026.

6. Manage performance like a partnership, not a purchase

Scorecards outperform fire drills. PwC’s 2024 Cloud and AI Business Survey found that 61 percent of top-performing companies “strongly agree” their primary cloud or IT vendors provide KPIs and performance monitoring that help them control usage and cost, compared with just 39 percent of other firms. Data-rich relationships lead to faster root-cause analysis and stronger contract terms.

A practical cadence looks like this:

- Quarterly business review (QBR). Share uptime, ticket-response, patch-latency, and audit scores on one page. Highlight wins and flag dips while they are still reversible.

- Joint risk radar. Discuss roadmap changes, subcontractor additions, and capacity constraints before they become surprises.

- Action-item tracker. End every meeting with assigned owners, due dates, and next-step validation.

When metrics flow continuously and conversations stay proactive, remediation feels collaborative rather than punitive, and unplanned downtime drops along with breach probability.

7. Prepare for the worst with vendor-specific incident plans

Tabletop drills are more than checklist theater. IBM’s 2024 Cost of a Data Breach report shows that organizations with a tested incident-response plan save an average of $2.7 million per breach, nearly 60 percent less than peers that never test their plans. Gartner echoes the point, advising CISOs to conduct third-party incident-response planning after finding that 45 percent of firms endured a vendor-caused business interruption during the past two years.

A resilient playbook folds vendor scenarios into the corporate IR plan:

- Contact matrix. Store names, phone numbers, and decision rights for both sides in one place.

- Triage script. Confirm scope, cut risky connections, start forensic logging, and draft customer communications within hours.

- Continuity fallback. Keep pre-approved backup providers, sanitized data exports, and exit clauses that compel cooperation if a vendor goes dark.

- Semiannual drills. Run tabletop exercises twice a year to build muscle memory and spot gaps before attackers do.

When a supplier outage or breach strikes, a rehearsed plan turns confusion into coordinated action, contains damage, meets disclosure deadlines, and shows stakeholders that resilience is real.

8. Stay ahead of the regulatory curve

The rulebook is expanding in every jurisdiction. The IAPP now tracks 144 countries with comprehensive data-privacy laws, up from 120 in 2017. In the United States, seven states passed new privacy statutes in 2024, bringing the total to 19. Fines are rising too: GDPR penalties reached €2.6 billion in 2024, a 14 percent increase year over year.

Treat compliance as a living workflow:

- Appoint a single owner. Privacy or Legal should track draft bills, map gaps, and push updates the moment a proposal becomes law.

- Push changes downstream. Update contract templates, onboarding checklists, and vendor scorecards so suppliers attest to the same obligations you follow.

- Prove it on demand. Store certifications, attestations, and assessment reports in your VRM system so regulators and auditors can see evidence in minutes.

Meeting new rules faster than rivals turns regulatory churn into a competitive edge, helping you win deals where customers require visible compliance.

The payoff: from cost center to growth engine

Vendor-risk maturity pays in three currencies: cash, speed, and trust.

Hard cash. IBM’s 2025 Cost of a Data Breach report sets the average price tag of a third-party incident at $4.81 million, about 40 percent higher than breaches that start internally. Companies that use continuous vendor monitoring trim that loss by $1.9 million on average while spending a fraction of that on a VRM platform.

Operational agility. PwC’s 2024 Procurement Pulse finds that firms with real-time vendor risk scores onboard new suppliers 34 percent faster and close M&A deals 22 percent sooner than peers that rely on annual questionnaires.

Brand and insurance lift. Gartner’s 2025 cyber-insurance survey shows carriers cut premiums by an average 12 percent for policyholders that prove 24/7 vendor monitoring and tested incident plans. Buyers echo that preference: RFP teams shortlist suppliers with ISO-mapped VRM evidence 1.7 times more often than those without.

Together, proactive VRM does more than plug leaks. It protects earnings, accelerates go-to-market goals, and turns compliance diligence into a competitive credential.

Conclusion

Vendor risk in 2026 is a leadership issue, not a back-office task. The forces you’re facing, shrinking disclosure windows, swelling vendor ecosystems, ESG scrutiny, automation-as-baseline, and the merge of VRM with ERM, won’t slow down. The playbook is clear: replace spreadsheets with purpose-built tooling, publish and enforce a policy that mirrors enterprise risk, tier vendors by real business impact, monitor continuously, run vendor-specific incident drills, and keep contracts and controls aligned to fast-moving regulations.

Do the first 20% now, stand up a single vendor registry, wire continuous-monitoring for the High tier, and schedule a vendor tabletop, and you’ll capture 80% of the benefit: lower breach costs, faster onboarding and M&A diligence, stronger insurance terms, and cleaner board reporting. Done right, VRM stops being a compliance drag and becomes a growth enabler, proof to customers, partners, and regulators that your extended enterprise is resilient by design.

FAQ

What are the top three VRM priorities for 2026? Enable continuous monitoring for high-risk vendors, align VRM scoring and reporting with ERM dashboards, and automate evidence collection and certification tracking. Those three moves cut blind spots, speed disclosures, and free analyst time.

How often should we reassess vendors? Continuously monitor all critical vendors, then run deeper reassessments by tier: High (quarterly or semiannual), Medium (annual), Low (18–24 months). Always trigger an out-of-cycle review after scope changes, incidents, or regulatory updates.

What belongs on a vendor scorecard? Track uptime/SLA attainment, patch and vulnerability remediation time, number and severity of open findings, certification/attestation currency (e.g., SOC 2, ISO 27001), and security-incident counts. Keep it one page, trend-line the last 4 quarters, and review in QBRs.

How do we meet fast disclosure timelines if a vendor is breached? Pre-decide materiality criteria, add 24-hour vendor notification and audit-rights clauses, and keep a tested third-party incident playbook. Route vendor alerts into your SIEM and convene legal, privacy, and comms within hours—not days.

What does “continuous monitoring” actually include? External attack-surface and misconfiguration checks, leaked-credential and dark-web signals, breach/news monitoring, and certification expiry tracking. Pipe alerts to ticketing/SOC workflows so isolation, remediation, and comms kick off automatically.